At Gazelle, while we delve deeply into financial and blockchain engineering, our primary mission is to eliminate the UX hurdles around gas management, which are significant barriers to the broader adoption of crypto. We began by asking ourselves a fundamental question: why hasn't gas hedging seen widespread adoption in the crypto community?

UX Focus

Our investigations pointed to two critical areas: insufficient focus on the end-user experience (UX) and a lack of demand for the short side of volatility in the gas markets. In subsequent posts, we will delve deeper into how we are tackling the asymmetry in gas market demand. Here, we focus on the UX aspects.

The current state of crypto UX is akin to navigating a maze — complicated and user-unfriendly. Users today are accustomed to the seamless experience of Web2, where the cost per megabyte of internet data is not a concern, and websites refresh without multiple clicks or checks on background processes. In stark contrast, the Web3 experience often involves checking gas fees, ensuring sufficient funds, and dealing with transaction failures due to underestimated costs. These issues are alien and off-putting to potential users we aim to onboard. To reach the next billion users, we need to overhaul this experience drastically.

Introducing Gazelle Subscriptions

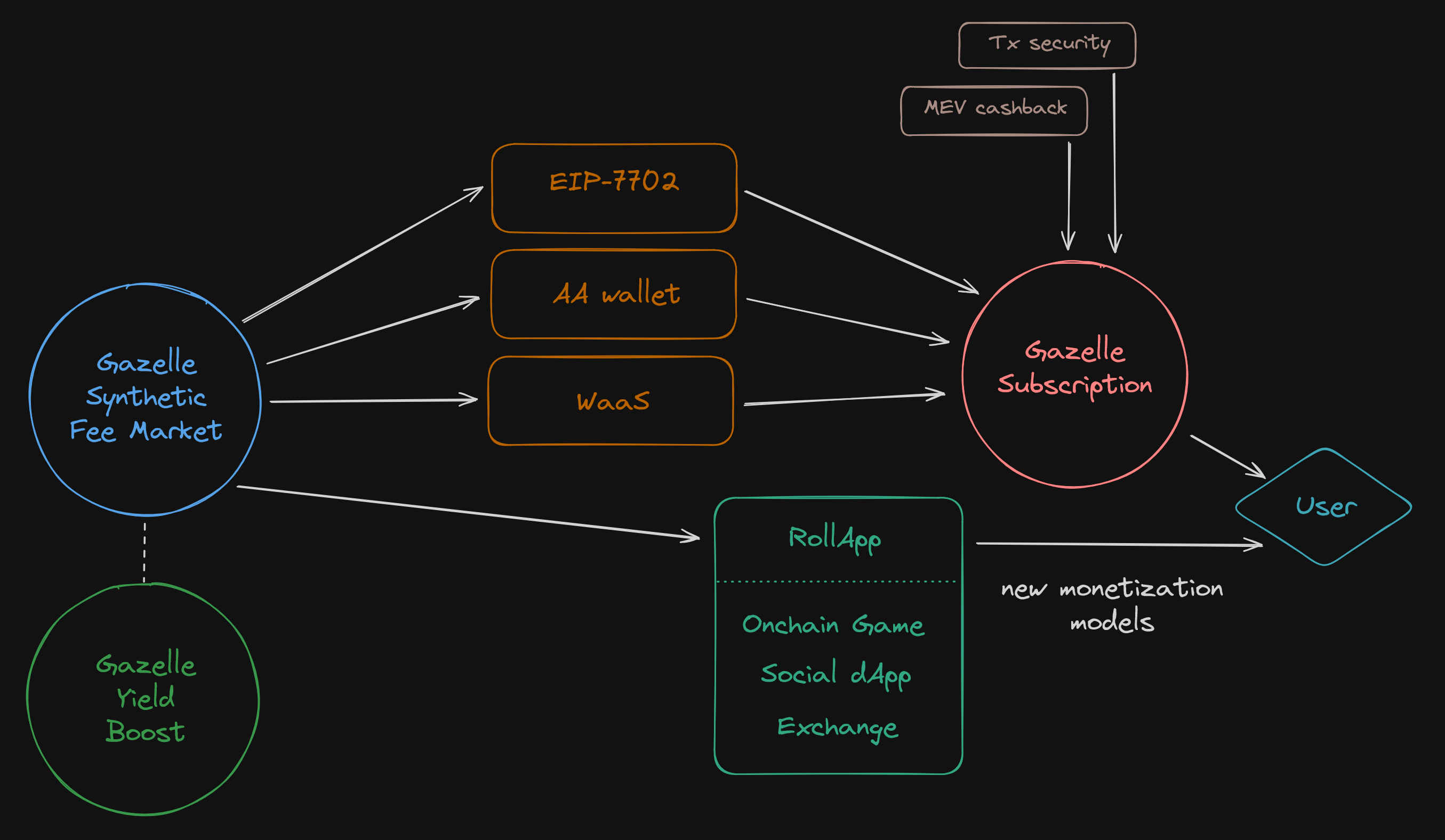

Gazelle Subscriptions are designed to provide a seamless and frictionless gas management experience. Our goal is simple: eliminate the complexities of gas management for users. We achieve this by bundling transaction fulfillment into a gas derivative contract. During the subscription period Gazelle covers the gas costs for user transactions through various optimized channels, ensuring users stay unaware of the underlying gas mechanics.

Sponsorship Delivery

For account abstraction wallets and wallets-as-a-service, Gazelle acts as both a bundler and a paymaster. After purchasing a subscription, users can transact freely, knowing their transactions are transparently sponsored and executed without any additional steps. For EIP-7702 (or EIP-3074) enabled wallets, we offer a customized sponsored invoker contract or an entry point for regular invoker contracts, tailored to integrate seamlessly with users' preferred wallets.

Subscription Specifications

At Gazelle, we continuously research and develop various subscription options to cater to diverse user needs. We offer different subscription tiers, each tailored to specific user profiles:

-

Basic: Ideal for new and unsophisticated users who prefer simplicity and do not want to deal with protocol details. This tier offers basic gas credits and essential transaction fulfillment services.

-

Advanced: Suitable for more experienced users, providing higher gas credits, faster transaction finality, and additional value-added services like MEV cashback.

-

Professional: Designed for sophisticated on-chain financial actors, offering the highest gas credits, priority transaction processing, and advanced features like block position specification.

-

Enterprise: Specified for Rollup-as-a-Service (RaaS) Infrastructure providers to bundle it into decentralized cloud offered to enterprises.

Our subscription models ensure that users, regardless of their familiarity with blockchain technology, can enjoy a seamless and efficient transaction experience.

RollApp Monetization Playground

We envision a future where numerous RollApps offer unparalleled flexibility through endless customization options. Both consumer and enterprise products will operate their decentralized applications (dApps) on RaaS infrastructure, in the decentralized cloud. Traditional monetization approaches, like per-transaction fees, make sense for generalized rollups such as Arbitrum which cater to sophisticated DeFi users.

However, RollApps will monetize similarly to Web2 applications, without explicitly mentioning transaction fees to their users. For example, a game might charge fees on virtual items traded on the auction house, a social app could rely on ad revenue, and a mobile banking app might impose fees on specific activities only. Gazelle facilitates these monetization models by fixing one of the two variable ends of this equation — the gas expenses of the rollup to Ethereum. This allows businesses to experiment with different monetization strategies, ultimately finding the one that best fits their user base.

Value-Added Services

By controlling the entire lifecycle of a transaction — from signature to finality — we can offer additional services directly to users. Two key subscription features we are currently developing are MEV Cashback and Gazelle Fuse:

-

MEV Cashback: This feature ensures that users benefit from the Maximum Extractable Value (MEV) in their transactions. Similar to cashback on purchases, users might receive unexpected notifications of extra funds entering their accounts, turning what would be an obscure process into a user-friendly benefit.

-

Gazelle Fuse: This security feature acts as a last-resort fuse, cutting short a transaction if a malicious contract attempts to drain a user's wallet. By managing transaction routing, we can quickly check against our partners' security databases and stop potentially harmful transactions even after the user has initiated them. This proactive approach significantly enhances user security and trust.

At Gazelle, we are committed to maximizing UX. If you have ideas on how we could integrate your services into our subscriptions, please reach out — we’re eager to collaborate and innovate together!