The gas abstraction space faces two critical unresolved issues: enhancing user experience (UX) and establishing a stable scalable demand for the short side of gas derivative contracts. In previous articles, we've discussed the rising need for hedged gas credits, the benefits of structuring them as monthly subscriptions, and our strategies for delivering these promises to users. In this article, we will focus on the financial engineering behind the Gazelle mechanism. We will explore the role of the insurance vault and how it reduces risk for underwriters, enables sector-specific pricing, and integrates with existing LSD yields to enhance them through diversified risk exposure.

Mutual Insurance Vault Mechanism

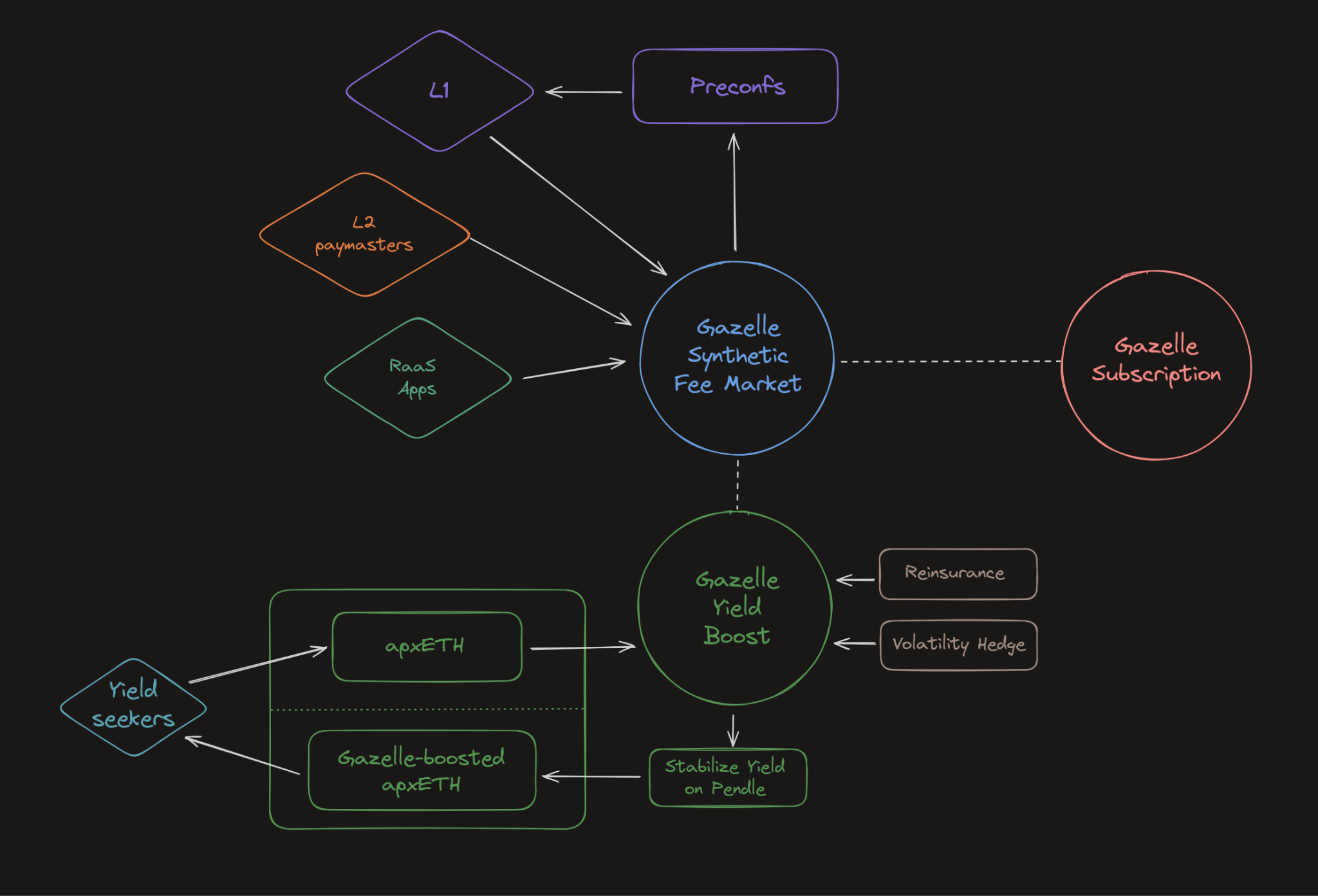

We believe there is insufficient demand from validators or speculators to underwrite gas insurance contracts. In an environment with fluctuating gas fees, taking a short position on specific users' on-chain activities entails high long-tail risk. With Gazelle, we are adopting a mutual insurance vault mechanism. This approach averages and distributes the risk of individual users executing transaction sponsorship requests at high gas prices. By sharing the risk coming from hedged gas subscription buyers as a whole among all vault depositors, the risk carried by each depositor is reduced.

Stabilizing Transaction Costs

Gazelle introduces a vault-based insurance marketplace to stabilize transaction costs across the EVM blockchains ecosystem. The platform will issue hedged gas credits, allowing users to lock in their transaction fees in advance by paying an upfront premium to the underwriting vault denominated in ETH. These payments can be made on a weekly or monthly basis, creating a convenient subscription plan tailored to individual users.

Integrating LSD Protocols for Yield

Significant amounts of ETH being staked in LSD protocols are evidence of large existing demand for low-risk stable ETH-denominated yield products. The size of this demand is orders of magnitude larger than the set of validators or speculators willing to trade gas futures. By introducing a novel ETH-based yield source with a diversified risk source, we are disrupting the LSD yields landscape and offering more choices to ETH holders.

If we target this demand group, we must compete with LSD yield providers on a risk-adjusted basis. Offering an insurance vault means that most of the assets in the vault remain unutilized, reserved for rarely occurring tail events. This realization led us to store a fraction of ETH deposits in LSD form, providing a yield floor for Gazelle depositors. By integrating this yield, we can offset total yield variation and more easily surpass benchmark yields.

The most scalable way to offer our yield to users is not by routing our deposits to LSD protocols directly. Instead, we aim to become a yield-boost option integrated natively within the existing LSD projects. This setup would allow users to opt into a Gazelle-boosted LSD vault version. In this model, approximately 70% of their deposit would go towards their chosen LSD while the remaining 30% would stay in ETH to sponsor gas for subscribed users and generate related yield. (The 70% figure is just an example of average expected amount of LSD allocation; the actual amount would be dynamically rebalanced based on market conditions.) We are currently in discussions with Redacted Cartel (soon to be Dinero Protocol) to utilize the Gazelle Yield Boost with their apxETH LSD.

Benefits of a Vault-Based System

Designing gas volatility underwriting as a vault provides further benefits. Feedback from future clients revealed that companies have diverse on-chain activity profiles and gas volatility exposures. Uniform derivative pricing would be unfair and could jeopardize the vault's funds. However, with a vault and our B2B Gazelle Subscription offering, we can implement a sharded vault accounting system. This system allows each of our partners to pay premiums adjusted to their activity while vault depositors can choose different risk tranches based on their yield appetite. This approach ensures a fairer, more robust pricing system and guarantees the vault's coverage payout under any conditions.

Synthetic Multidimensional Fee Market

The proposed design allows us to underwrite sponsorships with differentiated pricing for various market segments accurately. Additionally, it offers vault depositors a choice of yield and risk exposure. This resembles a synthetic multidimensional fee market created through insurance derivatives. Instead of pricing different transaction components separately, we add a time dimension by pricing gas volatility among different user categories. This approach provides more granular data and a more expressive protocol fee market. At scale, it would also help to reduce congestion by prioritizing different user profiles based on their execution needs. We believe this model could complement the future Ethereum in-protocol work of similar flavors rather than compete with it.

Risk Management and External Hedging

We are not placing all the risk on the precision of our pricing models alone. As we expand our subscription offering, we can tailor contracts with specific constraints on transaction sponsorship to better manage and control the overall risk. When we control execution, we can use the bottom of the block or delay the transaction to the next block if the retail purchaser of the subscription doesn't mind. For situations where tail risk exceeds model predictions, we can temporarily reinsure our vault through external blockspace futures protocols, capping losses for depositors during heightened risk periods. Additionally, our vault's short-gas exposure will inherently have some short-ETH-volatility exposure, which can be hedged in the future on generalized derivatives exchanges.

Proprietary Pricing Methods

Our pricing is based on proprietary methods developed with insights from a decade of experience in signal analysis in laser engineering and ultrafast spectroscopy. While we won't reveal our insights here, we can share that our initial results are promising. Even at this early stage, our approach yields satisfactory outputs and confirms our initial assumptions that a mutual insurance vault design is the right approach. We look forward to proving the models in production in the coming months.

Backtesting and Results

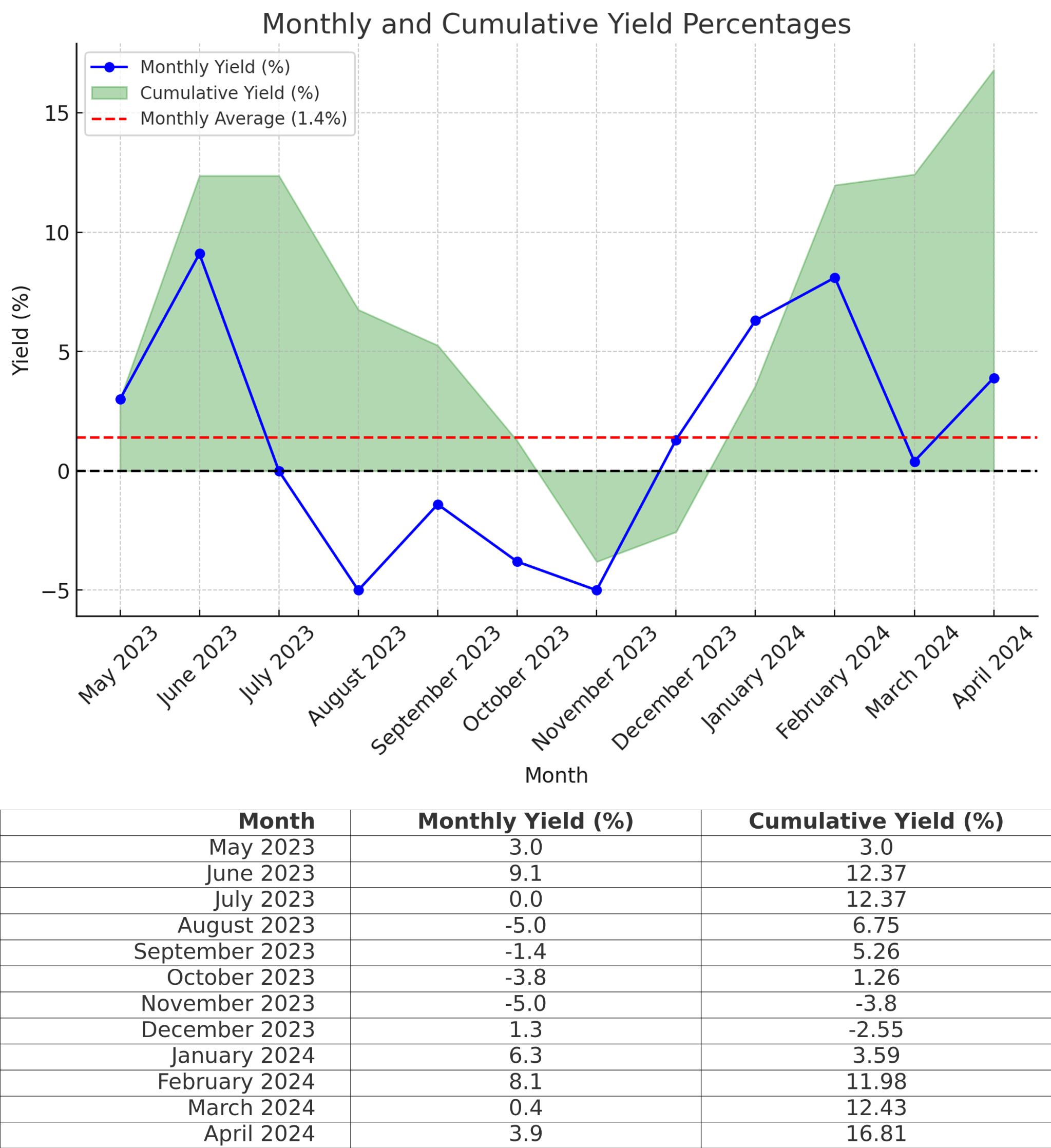

We analyzed Ethereum L1 gas prices from May 2023 to April 2024, testing a range of subscription parameters to evaluate how Gazelle impacts both sides of our marketplace. Our backtest assumed a gas sponsorship constraint between the average expected gas price from our model and 500 gwei. This range is reasonable since users are less inclined to use their hedged gas credits at low gas prices and our main goal was for robust backtesting of the core model by limiting high-end gas prices. In the future, we will offer varied subscription services, including some without high gas limits at all. The backtest also assumed that the subscription sold was a bundle of 10 AMM swaps sold monthly to 1000 buyers. For the LSD component, we assumed a 5% annualized yield on 70% of the vault’s TVL, which was taken to be 500 ETH.

Monthly Yields

This results in a total yearly yield of ~16.81%. Without the LSD component, the yield would have been 13%, indicating that while most of the yield comes from Gazelle, the LSD component helps mitigate monthly fluctuations on the downside.

The average swap cost of a Gazelle-mediated transaction over the 12 months was only $1.7 more expensive (around 2%) than the cost without Gazelle, providing users with the freedom to transact any time at high gas prices (up to 500 gwei) without worry as the cost of those swaps was already locked in.

Addressing Concerns and Future Improvements

A few months ago, Hasu voiced concerns about gas derivatives being unsolvable due to the high premiums required for such hedging or the low yields paid to underwriters. We believe our approach addresses this conundrum, offering both low premium payments on hedged gas subscriptions and attractive ETH-denominated yields to underwriters.

https://t.co/kGAn2v4K43 pic.twitter.com/klqlrczy6H

— kabat | Gazelle (@kabat)

April 27, 2024

The costs and yields will further improve as we refine our model. Implementing a vault sharding system with different risk tranches for underwriters and individualized pricing for different customer classes will enable Gazelle to offer a new fundamental source of ETH yield tied to on-chain activity, allowing ETH stakers to increase their yields in other ways than leveraging the same risk they are already exposed to.

This is just the initial step in verifying our pricing approach. We will continue to enhance the model fidelity, diversify subscription offerings for hedge buyers, and improve capital efficiency for hedge sellers.

Conclusion

In summary, Gazelle mechanism offers a promising approach to mitigating gas volatility risks through a mutual insurance vault system, integrating LSD protocols for yield enhancement, and providing a robust synthetic fee market. As we continue to refine our models and expand our offerings, we aim to develop a stable and attractive yield source for ETH holders and a reliable hedge against gas price fluctuations for users.